As fiscal sponsorship continues to become a more widely used tool for charitable impact, it is important that 501(c)(3) organizations acting as a fiscal sponsor are doing it right. Board members of sponsoring organizations must fully understand the role the organization is playing, its legal responsibilities and possible risks, and how to be a good steward and partner to its sponsored projects.

Fiscal sponsorship, at its core, is when a nonprofit organization extends its tax-exempt status to select groups engaged in activities related to the organization’s mission. Most often, fiscal sponsorship is used by organizations, individuals, or collaborations who are doing charitable work but who want an alternative to becoming a 501(c)(3) organization with the IRS. In a fiscal sponsorship arrangement, the sponsor accepts tax deductible donations and grants on behalf of the sponsored project/organization. The sponsor accepts responsibility for the use of those funds and ensures their application toward charitable purposes, along with any additional donor restrictions. To ensure this is not merely a pass-through of charitable dollars from the 501(c)(3) to the project, the IRS requires that the sponsor have “complete discretion and control” over the funds.

Fiscal sponsors often offer additional services and supports to their sponsored projects; the range of services provided varies by sponsor. Most fiscal sponsors charge sponsored projects a fee to offset the additional cost. Generally, that fee is somewhere between 5%-10% of all funds held on behalf of the sponsored group.

If you have a discernible fiscal sponsorship program or line of work, it will be quite evident. But, sometimes nonprofits act as a fiscal sponsor without any stated intent of doing so. This is more common than you’d think. Nonprofits have relationships with people or organizations that have great ideas and develop projects that are closely aligned with an organization’s mission; since nonprofit leaders want to help in whatever way they can, they sometimes develop an ad hoc fiscal sponsorship arrangement. These fiscal sponsorship relationships are arranged and as time passes and staff change, it’s easy to lose track of the boundaries between the project and the sponsor. This is especially true if the sponsorship isn’t periodically renewed or revisited.

So how do you know if your organization is acting as a fiscal sponsor? If your organization is holding money separately from your operating funds for a program or organization whose director or leader has a considerable degree of autonomy, sometimes separate from your nonprofit’s organizational structure, it is likely you are acting as a fiscal sponsor. If you think this may the case, it is important you work with an expert to ensure you are following legal requirements and best practices.

As fiscal sponsorship continues to become a more widely used tool for charitable impact, it is important that 501(c)(3) organizations acting as a fiscal sponsor are doing it right. Board members of sponsoring organizations must fully understand the role the organization is playing, its legal responsibilities and possible risks, and how to be a good steward and partner to its sponsored projects.

After ensuring you fully understand potential risks involved, ask yourself the following questions:

Any project/organization that you fiscally sponsor must be nonprofit/charitable in nature, not engaged in anything that would endanger your own 501(c)(3) status, and be doing work that is in line with your own mission statement. Beyond that, you can elect to sponsor based on viability, organizational capacity, or any additional factors you elect to consider. You’ll want to be very clear with potential projects what you’re basing your decision on and how their work fits into the organization as a whole.

When acting as a fiscal sponsor, it is important to understand what model of sponsorship you are providing. There are several models of fiscal sponsorship that an organization may follow. These models are outlined in Fiscal Sponsorship: 6 Ways to Do It Right by Gregory L. Colvin. Each model is administered differently so understanding and following best practices for your model is integral to being a sound fiscal sponsor. Too often, sponsors create hybrid models that are improper uses of fiscal sponsorship.

A contract is key to making sure your fiscal sponsorship operates effectively and communication between sponsor and sponsee remains clear. This piece of the fiscal sponsorship relationship is absolutely critical. While specific elements will vary depending on the type of sponsorship put in place, all good contracts will spell out the nature and term of the relationship, including model of fiscal sponsorship, ownership of intellectual property and dispute/indemnification clauses, list any fees charged, and outline the process for holding and disbursing funds. It should also have an “out clause” stating under what conditions either party can end the relationship and how remaining funds will be handled should that occur. All contracts must be signed and countersigned by both parties.

Having your contract reviewed by an attorney is an essential step for any organization acting as a fiscal sponsor.

Depending on whether you’re establishing one or a few individual sponsorships, or a formalized fiscal sponsorship program, your application and approval process will look different. Under all circumstances, though, the process for reviewing sponsorship applications should include an element of board participation. Those board members involved can report back to the full board on any new projects, concerns with the program, or questions that deserve full deliberation. You should also have clear criteria on when and why you would bring on a new project for sponsorship.

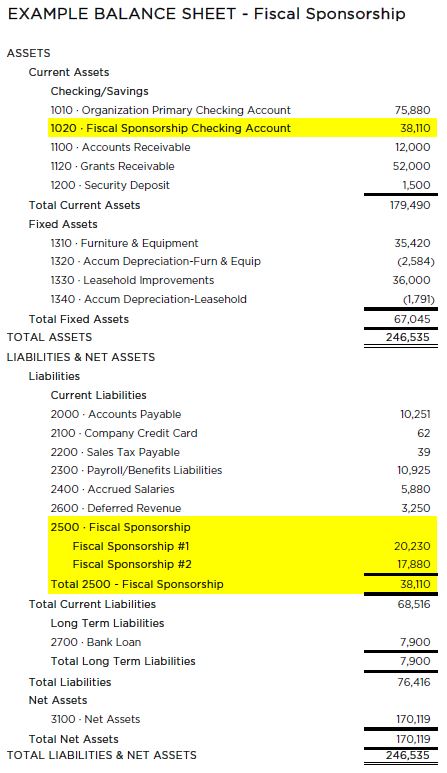

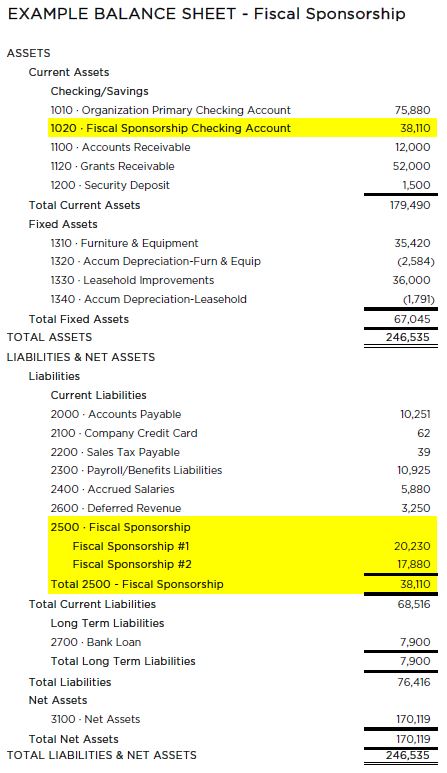

The most fundamental aspect of fiscal sponsorship is ensuring that you are holding the right amount of funds for the project and that those funds are readily available. It is ultimately the responsibility of the board of directors of the sponsoring organization to ensure these funds are being properly accounted for and are not being used to supplement the sponsoring organization’s cash flow. While this can be reflected on an organization’s financials in more than one way, our example here (see attached illustration) showcases that one of the simplest checks for this model that a board can exercise is ensuring that fiscally sponsored assets and liabilities zero out on the balance sheet. Additional best practices include holding all fiscally sponsored project funds in a separate banking account, keeping it separate from your programming and operations in your financials, and keeping clear operational records to supplement and support your financial documents.

It is also important to ensure you accurately reflect the fiscal sponsorship relationship on your audit and IRS Form 990. The best way to do this is to hire a Certified Public Accountant (CPA) or firm that has experience in fiscal sponsorship and knows which practical steps to take in order to adequately test and reflect the relationship. Whether you’ve got a full fiscal sponsorship program, an individual sponsee, or a handful of sponsored projects, the process of auditing them will be similar.

Fiscal sponsorship is an important and useful tool for the charitable community. As fiscal sponsorship becomes more prevalent, it is increasingly important that sponsoring organizations follow best practice guidelines. While this document provides a resource for organizations acting as fiscal sponsors, it is up to each organization to decide if they should act as a fiscal sponsor and, if so, do it right.

Copyright © 2024 Propel Nonprofits